The Zero-Trust Protocol: Defending Your Assets Against Address Poisoning & Contract Drains

In the traditional banking world, security is someone else's job. If a hacker drains your credit card, you call a hotline, file a dispute, and get reimbursed. In the blockchain ecosystem, that safety net does not exist. You are the bank, the vault, and the security guard.

If you lose your private keys or sign a malicious transaction, no government agency can bail you out. The harsh reality of self-custody is that the blockchain is an adversarial environment. Hackers are not just looking for bugs in the code; they are exploiting bugs in human psychology.

This guide moves beyond basic advice like "enable 2FA" and dives into the advanced threat vectors targeting high-net-worth portfolios today, specifically addressing the rise of Address Poisoning and Infinite Approvals.

Threat Vector #1: Address Poisoning (The Copy-Paste Trap)

This is currently the most sophisticated "low-tech" attack in the industry. Here is how it works:

Attackers monitor the blockchain for large transfers. Let's say you regularly send USDT to a specific address ending in ...8842. The attacker uses a script to generate a "vanity address" that looks almost identical to yours—perhaps it starts with the same characters and ends with ...8842, but the middle characters are different.

They then send you a transaction of $0 (or a tiny amount of spam tokens) from this fake address. Now, that fake address sits at the top of your transaction history. The next time you go to copy-paste your address from your history, you accidentally copy the attacker's address because it "looks" right.

The Countermeasure:

Never copy addresses from your transaction history. Always use your "Address Book" or whitelist feature. For a deeper understanding of network verification, review our technical breakdown in the crypto wallet security and network guide.

Threat Vector #2: The "Infinite Approval" Drain

When you interact with a DeFi protocol (like Uniswap or Aave), you must first "Approve" the spending of your tokens. Most users click "Max" or "Default" out of convenience.

This gives the smart contract permission to drain all of that specific token from your wallet at any time in the future, without further permission. If that protocol's contract key is compromised years later, your wallet can be drained while you sleep.

This risk is amplified when dealing with complex wrapped assets. As noted in our analysis of DeFi liquidity and wrapped tokens, these layers of abstraction often hide the permissions you are actually granting.

- Action Item: Use tools like Revoke.cash or Etherscan's Token Approval tool regularly to audit and revoke permissions for old contracts.

- Rule of Thumb: Only approve the exact amount you intend to swap, never "Infinite".

Threat Vector #3: Social Engineering & Airdrops

Greed is the hacker's best friend. If you see a new token appear in your wallet worth thousands of dollars that you didn't buy, do not touch it.

These are often phishing tokens. Trying to "swap" or "sell" them will trigger a smart contract function that drains your legitimate assets. We covered this extensively in our December crypto threat report regarding holiday scams. The rule is simple: If it looks too good to be true, it is a wallet drainer.

The Cold Storage Mandate

For any amount of crypto you are not willing to lose, Hot Wallets (MetaMask, Trust Wallet, Phantom) are insufficient. They are permanently connected to the internet and vulnerable to browser exploits.

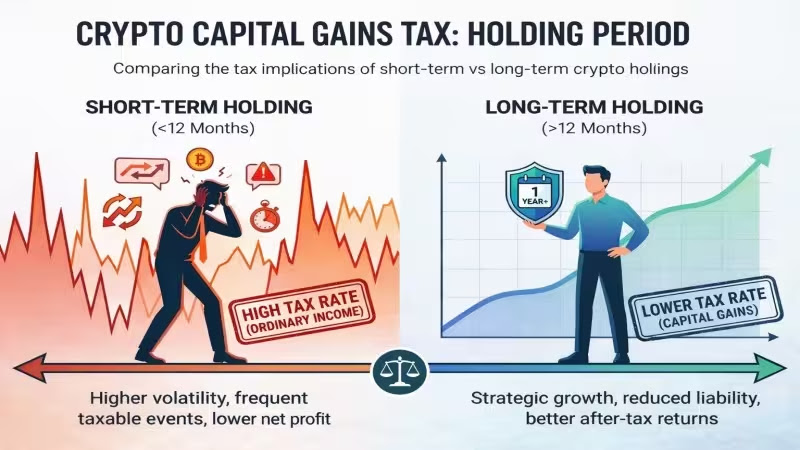

Institutional security requires an "Air-Gapped" approach—a hardware wallet that never physically touches an internet-connected device. Whether you are holding Bitcoin or engaging in long-term risk-off strategies, your private keys must remain offline.

However, if you must use a centralized custodian, ensure they have rigorous proof-of-reserves. You can see how we evaluate these standards in our Gemini exchange security review, which serves as a benchmark for what to look for in a trustworthy platform.

Final Thoughts: The Mindset Shift

Security is not a product you buy; it is a process you adhere to. It involves friction. It means double-checking every character of an address. It means using a dedicated laptop for finance. It means ignoring direct messages on Discord and Telegram.