For the better part of a decade, the cryptocurrency ethos was defined by a libertarian fantasy: a parallel financial system operating outside the purview of state observation. That era has definitively ended. Ironically, the very feature that makes blockchain revolutionary—its immutable, public ledger—has turned it into the ultimate tool for fiscal surveillance.

As institutional capital floods the market, the narrative has shifted from "hiding assets" to "defending wealth." Regulators in Tier 1 jurisdictions (United States, UK, EU, Canada) are no longer asking what Bitcoin is; they are implementing automated frameworks like the OECD’s Crypto-Asset Reporting Framework (CARF) to ensure they get their cut. The biggest risk to your crypto portfolio in the next decade is not a rug pull or a bear market; it is the retroactive enforcement of tax liabilities on transactions you assumed were private.

The "Property" Classification Trap

The fundamental friction in global crypto regulation lies in its classification. While the industry refers to it as "currency," major tax bodies like the IRS and HMRC treat it strictly as property or commodities. This distinction is not merely semantic; it destroys the utility of crypto as a medium of exchange for the compliant user unless you are using specialized tools.

Under this framework, purchasing a coffee with Bitcoin is not a simple payment; it is a taxable disposal. You must calculate the difference between the Cost Basis and its Fair Market Value at the moment of purchase. This creates a complex web of crypto taxable events and capital gains obligations that many investors inadvertently ignore until they receive a centralized exchange audit notice. Every trade, every swap, and every purchase is an event that triggers a potential tax bill.

Understanding Capital Gains: Time is Money

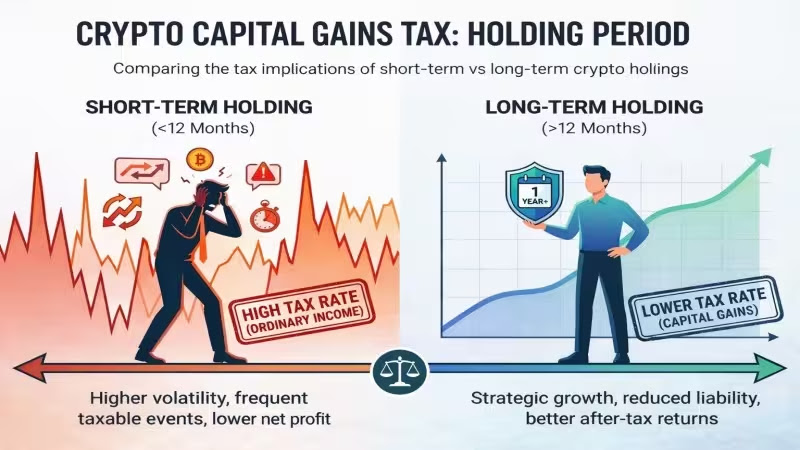

In the eyes of the taxman, not all profits are created equal. The duration for which you hold an asset significantly impacts how much tax you pay. This is where the distinction between capital gains tax on crypto: short-term vs long-term becomes the most critical component of your exit strategy.

Short-term gains, typically from assets held for less than a year, are often taxed at your regular income tax rate, which can be punishingly high (up to 37% or more in some jurisdictions). Conversely, long-term gains enjoy preferential rates (often 0%, 15%, or 20%). This incentivizes the "HODL" mentality not just as an investment philosophy, but as a tax-efficiency maneuver. However, tracking the holding period for specific fractions of Bitcoin bought at different times requires meticulous record-keeping.

The Hidden Income: Staking, Mining, and Airdrops

Most investors understand that selling crypto for profit is taxable. However, fewer realize that earning crypto is taxed differently. When you receive rewards from staking, mining, or airdrops, you aren't generating capital gains initially; you are generating ordinary income.

According to the crypto income tax guide for staking and mining, the Fair Market Value (FMV) of the coins at the exact time you receive them is considered income. You owe tax on that amount regardless of whether you sell the coins or not. If the price crashes effectively to zero after you receive the reward, you still owe tax on the value it had when it hit your wallet. This is a liquidity trap that has bankrupted many unprepared validators and miners during bear markets.

The DeFi & Web3 Complexity Layer

While centralized exchanges (CEXs) are now issuing tax forms, the true regulatory battleground has moved to Decentralized Finance (DeFi). The complexity here is exponential. Consider the mechanics of Liquidity Provision (LP). A conservative interpretation favored by auditors is that you have disposed of your assets in exchange for an LP token, triggering a taxable event immediately.

Furthermore, moving assets across chains adds another layer of tracking. For instance, moving stablecoins between networks involves fees and potential small conversions. Understanding the nuances of USDT networks like TRC20 vs ERC20 is crucial not just for saving on gas fees, but for tracking the cost basis of the gas used, which is a deductible expense against your capital gains in many regions.

Strategic Accounting: Beyond FIFO

In a market characterized by extreme volatility, the accounting method you select is effectively an active investment strategy. Most default settings on exchanges use FIFO (First-In, First-Out), which assumes you are selling your oldest coins first. In a bull market where your oldest coins likely have the lowest cost basis, FIFO maximizes your realized gains—and your tax bill.

Smart investors look deeper into the FIFO vs LIFO vs HIFO crypto accounting methods. specifically, HIFO (Highest-In, First-Out) is often the gold standard for tax minimization. By selling the coins you bought at the highest price first, you realize the smallest possible gain (or largest loss), thereby reducing your immediate tax liability. However, you must be consistent; you generally cannot flip-flop between methods year-to-year without flagging an audit.

| Strategy | Market Condition | Outcome Analysis |

|---|---|---|

| FIFO | Long-term Bull Trend | High Tax Impact. Selling assets with the lowest cost basis first. Good for long-term hold status, bad for immediate tax bill. |

| LIFO | Recent Price Surge | Moderate Impact. Useful if recent buys are profitable but less than early buys. |

| HIFO | High Volatility | Minimal Tax Impact. Selling most expensive acquisitions first to minimize gains or maximize losses. |

The "Wash Sale" Rule Loophole & Psychology

One of the few remaining advantages in crypto tax law (specifically in the US, though closing fast) is the lack of a "Wash Sale" rule for digital assets. In traditional stocks, you cannot sell a losing asset and buy it back immediately just to claim a tax loss. In crypto, because it is property, you often can.

This allows for aggressive Tax Loss Harvesting—selling at a loss during a market dip to offset your capital gains, and immediately buying back the asset to reset your position. This requires a strong stomach and an understanding of crypto investor psychology regarding capital loss. Many investors hesitate to "realize" a loss due to emotional attachment, but legally realizing that loss is the only way to make the red numbers in your portfolio work for you come tax season.

The Automation Imperative

The volume of transactions—staking rewards, trades, NFT mints, and bridges—makes manual spreadsheet tracking impossible. If you have more than 50 transactions a year, you are past the threshold of manual entry. Regulatory compliance now requires specialized crypto tax reporting tools and software compliance that can ingest API data and interpret on-chain data.

While major platforms provide some data, relying solely on them can be risky if you move funds off-chain. For example, a Gemini exchange review highlights their robust regulatory compliance and ability to generate tax forms, but they cannot track what you did with your Bitcoin after you sent it to a hardware wallet. This is where third-party tax software becomes non-negotiable for the serious investor.

Conclusion: The Cost of Legitimacy

Paying taxes on crypto is the ultimate proof of ownership. It transforms digital assets into legitimate, bankable wealth that can be used to purchase real estate or fund businesses without fear of seizure. The smart money isn't trying to outrun the IRS or HMRC; it is trying to keep the books clean while maximizing portfolio growth.

By understanding the classification of your assets, utilizing strategies like HIFO, and automating your reporting, you move from a speculative gambler to a sophisticated investor. In the regulated future of crypto, compliance is the new alpha.