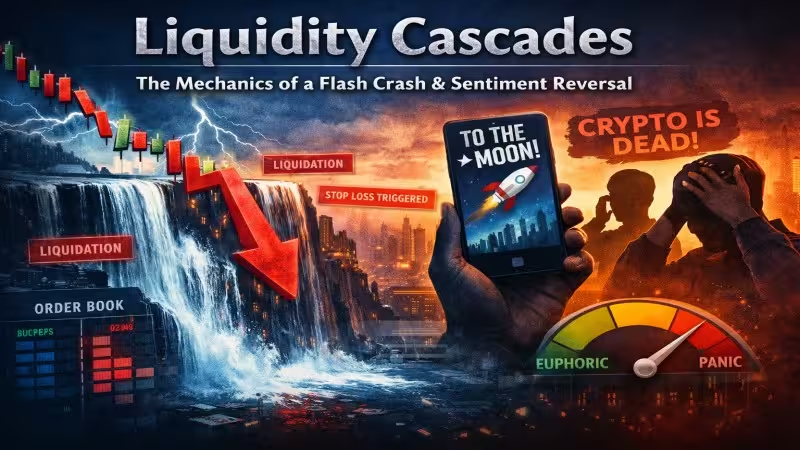

You wake up, check Twitter, and see bullish news. The charts look primed. You enter a 10x long. Twenty minutes later, you get a liquidation notification. The price dropped 15% in a single candle, wiped out your stop loss, and then—just to add insult to injury—bounced right back up to where you bought.

Most retail traders scream "Manipulation!" or blame the exchange. But if you look at the order book, the truth is far simpler and uglier: You were a victim of a Liquidity Cascade.

In this guide, I’m going to skip the academic definitions. We are going to dissect exactly how market structure fails, why market psychology creates traps, and how you can stop donating your money to market makers.

The "Burning Theater" Mechanics

Imagine a movie theater with 500 people inside (the Longs) but only one small exit door (the Bid Depth/Liquidity). As long as everyone sits calmly, the price is stable.

A Liquidity Cascade is what happens when someone yells "Fire!" The first few people get out easily. But once the panic starts, the crowd crushes against the door. In crypto, the "exit door" is the Buy Orders waiting in the order book. When there are more sellers than buy orders, the price doesn't just slide down—it teleports.

1. A whale sells or bad news hits → Price ticks down 2%.

2. Degens with 50x leverage get liquidated immediately.

3. The Exchange Engine creates "Market Sell" orders to close those positions.

4. This aggressive selling eats up the order book, pushing price down another 5%.

5. Now the 20x leverage traders get liquidated.

6. Loop repeats until the leverage is flushed.

During a cascade, charts and fundamentals do not matter. The market is simply an algorithm hunting for liquidity. It will keep crashing until it hits a "wall" of real cash buyers who aren't using leverage. That's why you see those massive V-shape wicks.

Why Your Twitter Feed is lying to You

If you trade based on what you see on social media, you are essentially trading looking in the rear-view mirror. Sentiment is a lagging indicator. By the time "Crypto Twitter" is panicked, the smart money has already finished selling.

| Market Phase | What You See on Chart | What Twitter Says | What Whales Are Doing |

|---|---|---|---|

| The Top | Price Stalling | "We are going to $100k!" 🚀 | Dumping bags on retail |

| The Flush | Red Candles | "Buy the dip!" (Denial) | Pulling bids, waiting for panic |

| The Bottom | Long Wicks | "It's over, I'm quitting." 💀 | Aggressive Spot Buying |

I see this every cycle with meme coins. Look at the Dogecoin sentiment data; usually, the safest time to buy is when everyone is mocking the coin, and the most dangerous time is when your taxi driver asks you how to buy it.

The "Weekend Wick" Danger Zone

Ever noticed how the nastiest crashes often happen on Saturday night or Sunday morning? That's not a coincidence.

Institutional market makers (the guys who provide the "thick" order books) are humans. They take weekends off. When they pull their liquidity bots, the order book becomes "thin." In a thin market, it doesn't take a whale to crash the price—even a medium-sized dolphin can cause 10% slippage.

This is even worse in DeFi. As I wrote in the analysis of DeFi holiday liquidity, AMMs are stupid. They don't adjust spreads like humans. If you are trading on-chain during a holiday weekend, you are asking to get wrecked by slippage.

Spotting the Fake Recovery (Dead Cat Bounce)

So the price crashed 20%. Is it time to buy?

Here is the golden rule: Look at Open Interest (OI).

If price goes UP but Open Interest goes DOWN = Healthy. Shorts are covering. Real spot buying is happening.

If price goes UP and Open Interest goes UP = Trap. Greedy longs are re-entering too early. They are just fuel for the next crash.

You need to understand Risk-On vs Risk-Off cycles. A real recovery is quiet. A fake recovery is loud and leverage-heavy.

Survival Guide: How to Catch a Knife without Bleeding

The most profitable trade I ever made was setting a buy order 30% below the market price and going to sleep.

"You don't get paid for predicting the rain. You get paid for building the ark."

We call these "Stink Bids." You identify a historical support level, and you place your orders there before the crash happens. When the cascade triggers, the algorithm wick slams into your order and bounces instantly. You provide liquidity when everyone else is demanding it.

But be warned: trying to manually time the bottom is a recipe for disaster. Emotional control is everything. Read up on psychology regarding capital loss because watching your portfolio drop 40% in an hour will break you if you don't have a thesis.

Final Thoughts

Flash crashes aren't bugs; they are features of a free market clearing out the garbage (excess leverage). They transfer wealth from the impatient to the patient. Stop staring at the 1-minute chart, zoom out, and wait for the liquidity to come to you.