The Friction Between Mind and Math: Decoding the Crypto Market’s Core Engine

The digital asset market is frequently dismissed by outsiders as a chaotic digital casino, but this perspective misses the underlying machinery entirely. Beneath the violent price swings lies a logical, albeit brutal, collision between human neurological limits and algorithmic economic design. To survive this arena, one must stop viewing charts as random lines and start seeing them as a visualization of mass psychology clashing with rigid supply mechanics.

To truly understand this ecosystem, we must define the two forces at play. First, Crypto Market Psychology: the collective emotional state of participants that dictates short-term price discovery through fear, greed, and social proof. Second, Tokenomics: the mathematical framework of supply, inflation, and utility that determines an asset’s terminal value. While psychology moves the needle today, tokenomics determines if the asset survives the decade.

Most capital loss in this space doesn't stem from "bad tech" or hacks, but from a fundamental misalignment between an investor’s emotional timeline and a token’s emission schedule. To survive, you must master the art of mastering crypto psychology and tokenomics strategy. Without this duality, you aren't investing; you are simply providing exit liquidity for those who have done the math.

The Behavioral Trap: Why Your Brain is Not Wired for Crypto

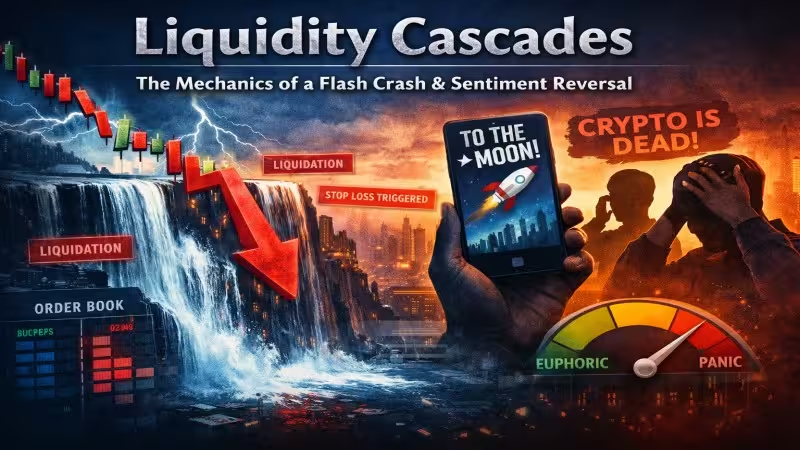

Human evolution did not prepare us for 24/7 high-stakes digital trading. Our brains are biologically designed to seek safety in herds (FOMO) and react violently to perceived loss (Panic Selling). In the crypto sphere, these instincts are weaponized by market makers and sophisticated algorithms.

The most dangerous phase is not the bear market, but the "Euphoria" stage. When social sentiment reaches a fever pitch, logical risk assessment evaporates. This is where disciplined players utilize crypto trading psychology and risk management to detach emotion from execution. If you find yourself checking your portfolio every ten minutes for a dopamine hit, you have already lost the psychological battle. You are trading your serenity for volatility.

Furthermore, investors often suffer from the "wealth illusion." Seeing a high portfolio balance during a bull run often leads to reckless spending before profits are realized. It is crucial to understand that net worth is not wealth until it is converted into a stable store of value. Paper gains are merely vanity metrics until the sell button is clicked.

| Market Phase | Retail Reaction (Emotional) | Smart Money Reaction (Strategic) |

|---|---|---|

| Accumulation | Boredom, Fear ("Crypto is dead") | Quiet accumulation of high-conviction assets. |

| Uptrend / Markup | Disbelief, then FOMO chasing pumps. | Holding spot, hedging downside risk. |

| Distribution (Top) | Euphoria, Leverage ("Supercycle"). | Selling into liquidity strength (Exit Liquidity). |

The Math of Value: Tokenomics as a Reality Check

If psychology is the wind that moves the ship, tokenomics is the hull. You can have the strongest wind (hype), but if your hull is full of holes (inflationary supply), you will eventually sink. The most common trap for retail investors is ignoring the distinction between Market Cap and Fully Diluted Valuation (FDV).

Many "low-priced" tokens attract retail buyers who believe they are finding the next Bitcoin. However, deep analysis of crypto tokenomics: market cap vs FDV reveals that many of these projects have massive hidden inflation. When early VCs and team members unlock their tokens (vesting cliffs), the resulting supply shock often crushes price, regardless of how "good" the tech is.

- Aggressive Emission Curves: If 50% of the supply enters the market in the next 12 months, buy pressure must double just to keep price flat.

- Predatory Vesting: Short lock-up periods for insiders usually lead to "pump and dump" price action.

- Artificial Utility: If a token's only use is "governance" in a protocol where no one votes, it lacks a fundamental floor.

Analyzing Market Cycles: Risk-On vs. Risk-Off

Tokenomics does not exist in a vacuum; it operates within the broader context of global liquidity. Crypto is highly sensitive to macro-economic shifts. Understanding risk-on vs risk-off crypto market cycles helps investors determine when to prioritize high-beta altcoins (Risk-On) and when to retreat to Bitcoin or Stablecoins (Risk-Off).

In a "Risk-On" environment, psychology dominates, and even tokens with poor tokenomics can fly. However, when the cycle shifts to "Risk-Off," the market ruthlessly filters out projects with high inflation and low revenue. This is when the math of tokenomics reasserts its dominance over the narrative.

The Practical Application: Finding Real Utility

The gold standard for any asset is the transition from speculation to utility. We see this most clearly in protocols that solve existing economic frictions rather than just creating new tokens for the sake of it.

A prime example of tokenomics serving a real-world purpose is the Basic Attention Token (BAT) model. By re-engineering the relationship between users, advertisers, and publishers, BAT creates a closed-loop economy where the token is required for the system to function. This creates a "natural buyer" (advertisers) that supports the price independent of speculative mania. This is the antithesis of a memecoin which relies purely on the "Greater Fool Theory."

Navigating Loss and Capitulation

Even with perfect analysis, losses occur. How you handle them defines your career. The phenomenon of crypto investor psychology regarding capital loss is fascinating; most people will hold a losing bag to zero rather than realize a 10% loss, hoping to "break even." This is the sunk cost fallacy in action. Tokenomics teaches us that if a token’s fundamentals have degraded (e.g., infinite mint exploit or team abandonment), the rational move is to salvage capital immediately, regardless of emotional attachment.

Conclusion: The Disciplined Path

Successful crypto investing is an exercise in boredom and discipline. It requires the ability to do nothing when the crowd is shouting, and the intellectual honesty to admit when the math no longer adds up. The most profitable "alpha" isn't found in a secret Telegram group or a paid discord; it is found in the whitepaper’s supply schedule and your own ability to stay calm when the world is in a frenzy.