Mastering Crypto Tokenomics: Quantitative Analysis of Market Cap vs. FDV

In the institutional-grade analysis of digital assets, understanding supply dynamics is paramount. Retail participants often fall victim to "unit bias," prioritizing low-priced tokens without calculating the underlying inflationary pressure. This oversight often leads to significant capital impairment as new supply enters the market.

While Market Capitalization provides a snapshot of current liquidity, it serves as an incomplete metric. For professional risk management, we must evaluate the Fully Diluted Valuation (FDV)—the total valuation of a project once the maximum supply is fully circulating. The gap between these two metrics is often where market psychology traps are set.

FDV represents the total theoretical market value if 100% of the token supply were released at current prices. A high FDV combined with a low Market Cap indicates massive "inflationary overhang" that will suppress price growth for years.

Quantitative Risk: A Comparative Case Study

To illustrate the impact of dilution, we compare two hypothetical projects with identical price points but radically different supply structures.

| Metric Analysis | Project A (VC-Backed / Low Float) | Project B (Mature / High Float) |

|---|---|---|

| Current Price | $1.00 | $1.00 |

| Circulating Supply | 10% (Artificial Scarcity) | 90% (Fair Distribution) |

| Market Cap | $10 Million | $90 Million |

| FDV (Target) | $100 Million | $100 Million |

| Inflation Risk | Extreme (900% Supply Shock) | Low (Stable) |

Project A requires 900% growth in demand just to maintain its current price as tokens unlock. In contrast, Project B—similar to established L1s like Solana during its mature phase—has already absorbed most of its supply shock, making it a more structurally sound investment for long-term holders.

The "Predatory" Institutional Meta

In modern market cycles, many Venture Capital (VC) backed projects launch with a "Low Float / High FDV" structure. By only releasing 5% of the supply to the public, market makers can easily pump prices with low volume.

This creates a distorted valuation. Retail investors see the price rising and FOMO in, unaware that they are buying immediately before a massive unlock event where VCs will dump their vested tokens.

Anatomy of Emissions: Linear vs. Cliff Unlocks

Professional analysts distinguish between two primary emission types found in whitepapers:

- Linear Emissions: Gradual release of tokens (e.g., block rewards), allowing the market to absorb supply consistently.

- Cliff Unlocks: Large percentages of supply released on a specific date. This is a "Liquidity Event" where early investors often realize 100x gains, crashing the price for retail holders.

Strategic Execution & Tax Efficiency

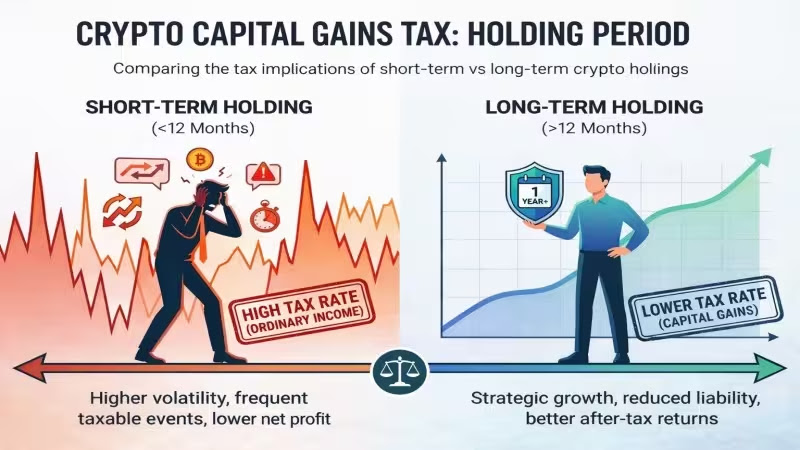

Understanding tokenomics also aids in tax planning. Holding a high-inflation token long-term is often a losing strategy. It is crucial to align your holding period with the project's emission schedule.

Additionally, realized gains from timing these cycles correctly must be reported. Refer to our guide on crypto tax regulation to ensure your profits are compliant with local laws.

- Check Market Cap / FDV Ratio (Target > 0.6 for safety).

- Verify Insider Vesting Schedules (Avoid buying 30 days before a Cliff).

- Compare valuation relative to sector peers, not just token price.