Solana Liquidity Reflexivity: The Sentiment-Capital Feedback Loop

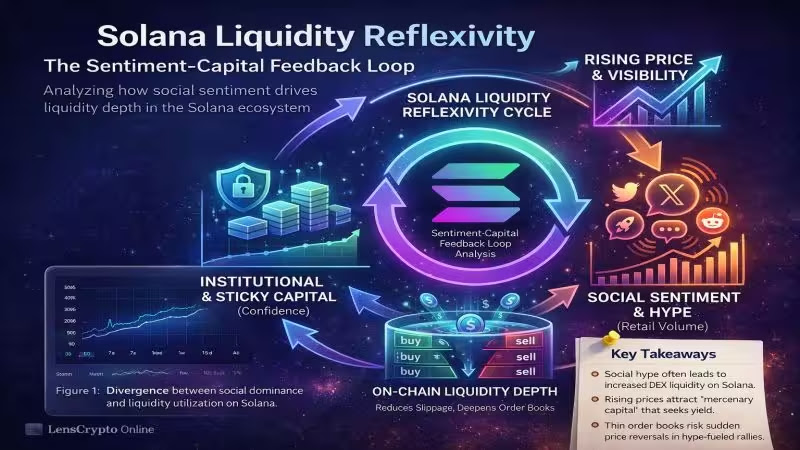

In high-beta asset environments, price action is rarely a function of technological throughput alone. It is driven by Liquidity Reflexivity—a theory adapted from George Soros—where rising prices attract social volume, which in turn deepens on-chain liquidity, further reducing slippage and inviting larger capital flows. Solana (SOL) has evolved into the primary theater for this mechanic, distinct from Ethereum’s collateral-heavy focus.

For the sophisticated market participant, understanding the distinction between "mercenary liquidity" and "sticky TVL" is paramount. This analysis dissects how social metrics act as a precursor to liquidity events, drawing on principles of risk-on market cycles and behavioral economics in crypto.

1. Quantifying the Sentiment-Liquidity Lag

Data indicates a consistent time lag between a spike in "Weighted Social Sentiment" and the subsequent deepening of order books on decentralized exchanges (DEXs). Unlike institutional markets where liquidity precedes price, retail-driven markets like Solana often see price precede liquidity.

This phenomenon is rooted in investor psychology. When retail traders perceive momentum, they bridge assets aggressively. However, monitoring stablecoin inflows (USDT/USDC) is crucial; price appreciation without fresh stablecoin issuance is merely leverage, not genuine demand.

2. Comparative Analysis: Sticky vs. Mercenary Capital

To navigate the Solana ecosystem effectively, one must categorize capital flows. Mercenary capital chases yield and narrative, while sticky capital seeks protocol solvency. The interplay between these two defines the Market Cap vs. Fully Diluted Valuation (FDV) dynamics.

| Metric | Mercenary Capital (Retail) | Sticky Capital (Institutional) |

|---|---|---|

| Trigger | Social Hype / FOMO | Yield Spread / Solvency |

| Duration | Intraday to Weekly | Quarterly to Yearly |

| Risk Tolerance | High (Variance seeking) | Low (Capital preservation) |

| On-Chain Signal | High Wallet Interaction Count | Increasing Staked SOL (Jito/Marinade) |

3. The Danger Zone: When Narrative Outpaces Liquidity

The most critical risk vector occurs when social sentiment hits a fever pitch (90th percentile) while on-chain liquidity depth begins to plateau. This divergence is a classic capital loss trap. During these phases, the "bids" in the order book thin out, meaning a relatively small sell order can crash the price disproportionately.

Below is the live market data for Solana. Observe the volume candles; low volume on uptrends often confirms the "Liquidity Air Pocket" theory discussed above.

Strategic Execution

Investors should look beyond simple price charts. The alpha lies in monitoring the ratio of Volume-to-TVL. A ratio that sustains above 1.5x suggests a highly overheated environment where reflexivity is about to reverse. Conversely, a low ratio during high social fear often marks a generational entry point for those who understand self-custody and security.