The Ad-Blocker That Pays You: Why Basic Attention Token (BAT) Is Fixing the Broken Internet

We need to address a structural flaw in the modern web: the digital advertising model is inefficient and invasive. What began as a simple exchange—content for eyeballs—has morphed into a complex surveillance network known as "Surveillance Capitalism." Users are tracked across devices, battery life is drained by heavy scripts, and publishers lose revenue to middlemen.

In this legacy ecosystem, the user is rarely the customer. Often, the user is the product being sold to data brokers.

Basic Attention Token (BAT) challenges this status quo. Unlike speculative meme coins, BAT is a working utility token integrated into the Brave browser (with over 60 million active users) that aligns the incentives of users, advertisers, and publishers.

The Structural Problem: Why Privacy Matters

Consider a standard browsing session. When a news article loads, dozens of third-party scripts fight for bandwidth. They map your behavior and auction your profile to advertisers in milliseconds. This is not just a privacy issue; it is a performance issue.

BAT operates on a philosophy that privacy is a prerequisite for a healthy economy. By using Client-Side Matching (machine learning that happens on your device, not in the cloud), Brave matches ads to your interests without your personal data ever leaving your browser.

| Feature | Traditional Model (Google/Ads) | BAT / Brave Model |

|---|---|---|

| Data Storage | Centralized Servers (Cloud) | Local Device Only (Privacy-Preserved) |

| Ad Matching | Based on Tracking Cookies | Based on Local Browser History |

| User Reward | 0% (You are the product) | 70% of Ad Revenue (Paid in BAT) |

| Speed | Slowed by Trackers | 3x Faster (Trackers Blocked) |

Tokenomics Velocity: The "Real" Demand

To understand the investment potential, we must look beyond the hype and analyze the fundamental metrics. Investors should closely examine the relationship between Market Cap and Fully Diluted Valuation (FDV). BAT has a fixed supply of 1.5 billion tokens, which is fully circulated. There is no inflation.

The Buy-Back Mechanism:

Advertisers pay for campaigns in Fiat currency (USD) or Crypto. When they pay in USD, the Brave protocol automatically purchases BAT from the open market to distribute to users. This creates constant, organic buy pressure that correlates directly with the browser's ad revenue growth, regardless of broader crypto market sentiment.

Users can then use these earned tokens to tip creators or swap them for other assets via the built-in Brave Wallet. For users new to self-custody, understanding crypto wallet architecture and security rails is essential before managing significant amounts of BAT.

How to Earn and Tax Implications

Earning is passive. Users simply enable "Brave Rewards" and browse normally. Subtle notification ads appear (which can be dismissed), and BAT accrues in the wallet.

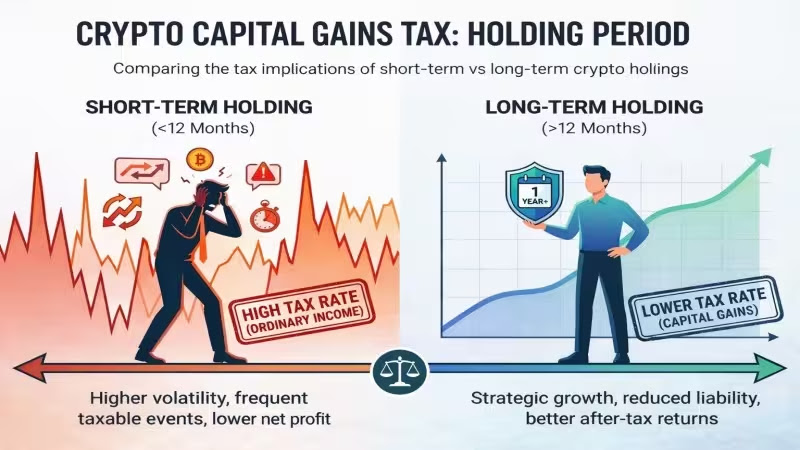

However, it is crucial to note that in many jurisdictions (including the US), receiving crypto rewards is a taxable event. We recommend reviewing our comprehensive crypto tax and regulation guide to understand how to report BAT earnings as income versus capital gains.

Market Performance & Analysis

BAT trades on all major cryptocurrency exchanges. The chart below displays BAT's performance against the US Dollar. Note the correlation between price spikes and major browser updates or partnership announcements.

The Verdict: Sustainable Utility?

BAT is not without risks. It faces massive competition from Google Chrome's entrenched dominance. Additionally, for the price to appreciate significantly, advertiser demand must outpace the sell pressure from users cashing out their monthly rewards.

However, as global privacy regulations (GDPR, CCPA) tighten, Brave's "privacy-by-default" model positions BAT as a compliant, future-proof alternative for digital marketing. It remains one of the few crypto assets with a working product used by millions of non-crypto natives daily.