In the decentralized ecosystem, financial sovereignty is intrinsically linked to technical literacy. While hardware wallets offer a physical layer of defense, the primary vulnerability for most investors isn't theft—it's a fundamental misunderstanding of Blockchain Settlement Layers.

Many investors treat a "Crypto Wallet" like a bank account—a digital container that holds coins. This is a dangerous simplification. A wallet does not store assets; it stores Private Keys. Your assets exist on the blockchain ledger, and your keys are merely the cryptographic signature required to authorize state changes.

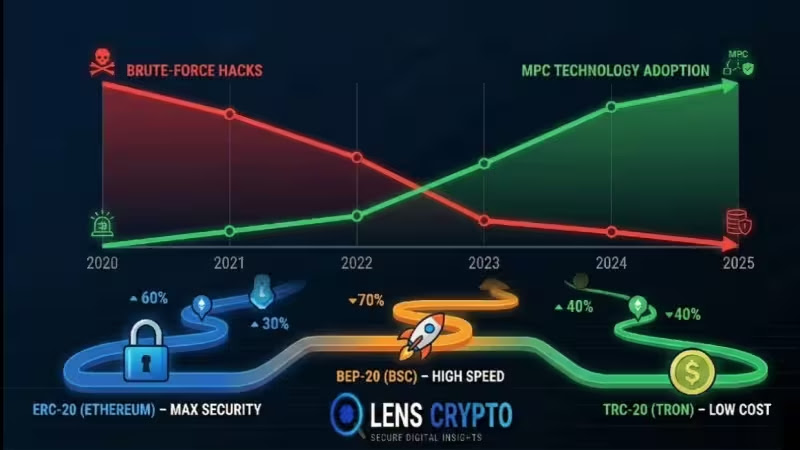

The complexity arises when these keys interact with different network standards. Sending a token via the wrong rail—for instance, mistaking an ERC-20 (Ethereum) address for a BEP-20 (BNB Chain) address—can result in the permanent destruction of capital.

The Core Doctrine: The "Address Collision" Risk

One of the most confusing aspects for intermediate users is the similarity of addresses. Ethereum (ERC-20), BNB Smart Chain (BEP-20), Polygon, and newer L2s like Base all use the EVM (Ethereum Virtual Machine) standard. This means your public address on all these networks is likely the same (starting with 0x...).

Because these networks share the same cryptographic derivation path (BIP-44), the same Private Key generates the same Public Address across all EVM chains.

The Danger: If you send ETH (ERC-20) to a wallet on the BNB Chain (BEP-20), the funds will arrive at that address, but on the wrong network. If you own the private keys (e.g., MetaMask), you can recover it by switching networks. However, if you send it to a Centralized Exchange (CEX) that does not support that network, the funds are effectively lost in the exchange's hot wallet.

Network Analysis 1: ERC-20 (The Gold Standard)

ERC-20 is the technical standard for fungible tokens on the Ethereum blockchain. It remains the bedrock of the crypto economy, hosting the vast majority of DeFi protocols and institutional assets.

- Consensus Mechanism: Proof of Stake (PoS). Ethereum has hundreds of thousands of validators globally distributed.

- Security Profile: Maximum. To reverse a transaction on Ethereum requires 51% of the total staked ETH, a cost that is economically unfeasible for any attacker.

- The Cost (2026 Update): While L2s have reduced load, Mainnet gas fees can still spike to $20-$100 per transaction during NFT mints or high volatility.

- Best Use Case: Cold storage of high-value assets (> $5,000) where safety outweighs cost.

Network Analysis 2: BEP-20 (The Efficiency Fork)

BEP-20 is the standard for the BNB Smart Chain (BSC). It was designed as a high-speed, low-cost alternative to Ethereum, compatible with EVM tooling.

- Consensus Mechanism: Proof of Staked Authority (PoSA). The network is secured by a limited set of active validators.

- Security Profile: Medium-High. While secure, it is more centralized than Ethereum. The smaller validator set allows for faster block times (3 seconds) but theoretically makes censorship easier.

- The Cost: Very Low. Typically $0.03 - $0.10 per transaction.

- Best Use Case: High-frequency trading, Yield Farming, and small-to-medium transfers.

Network Analysis 3: TRC-20 (The Payment Rail)

TRC-20 operates on the TRON network. Unlike the EVM chains above, TRON uses a different address format (starting with T...), making it impossible to accidentally confuse with an Ethereum address.

- Consensus Mechanism: Delegated Proof of Stake (DPoS). Super Representatives are voted in to validate transactions.

- Security Profile: Optimized for Throughput. It prioritizes speed over extreme decentralization.

- The Cost: Near Zero. This makes it the dominant rail for USDT Stablecoin transfers globally.

- Best Use Case: Remittances, Inter-exchange transfers, and payments.

| Feature | ERC-20 (Ethereum) | BEP-20 (BSC) | TRC-20 (TRON) |

|---|---|---|---|

| Address Format | 0x... (Hexadecimal) | 0x... (Hexadecimal) | T... (Base58) |

| Transaction Fee | High ($3 - $50) | Low ($0.05) | Very Low ($0.80) |

| Confirmation Time | ~12 Minutes (Finality) | ~3 Seconds | ~1 Minute |

Strategic Implementation: The 3-Tier Wallet System

To professionalize your security, avoid keeping all assets in one place. Implement the 3-Tier System:

- Cold Tier (The Vault): A Hardware Wallet (Ledger/Trezor) or Air-Gapped device. Used solely for ERC-20 long-term holding. Never connects to DApps.

- Warm Tier (The Trading Desk): A software wallet for active DeFi/NFT trading. Contains only what you are willing to lose. Use BEP-20 or L2s here for efficiency.

- Hot Tier (The Burner): A temporary wallet for minting new projects or interacting with unverified contracts. Funded only with the exact amount needed for the transaction.

Security in crypto is not a product you buy; it is a process you adhere to. By understanding the underlying rails of ERC-20, BEP-20, and TRC-20, you move from being a passive user to a sovereign custodian of your wealth.

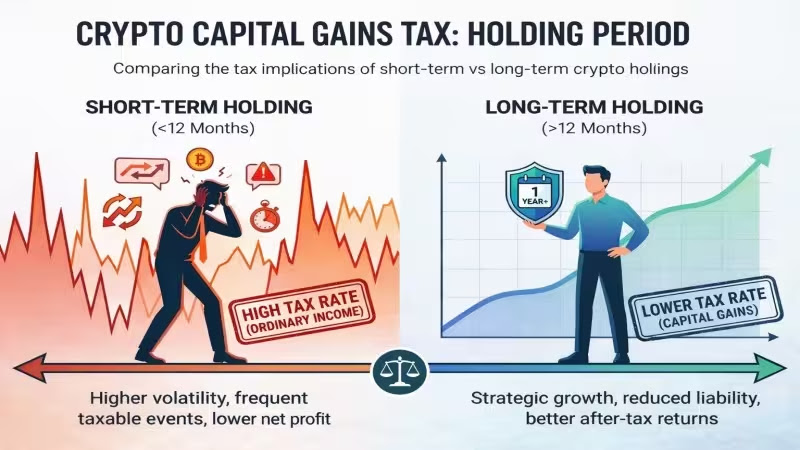

Finally, remember the tax implications of your transfers. Moving assets between your own wallets is generally not a taxable event, but converting between tokens on different chains often is. Consult our Crypto Tax Compliance Guide to ensure your record-keeping is accurate.